Amidst a dynamic economic backdrop, the Dow Jones Industrial Average capped off its eighth consecutive winning day, marking its strongest week of 2024 with an impressive performance. This rise in the Dow, coupled with significant gains across European markets and the United Kingdom’s escape from recession, paints a picture of resilient optimism in global financial markets. While the Dow gained largely, European indices also succeeded, with the Stoxx 600 hitting fresh record highs. This upbeat sentiment, however, is reduced by renewed inflation concerns following a less-than-optimistic consumer sentiment report in the US, setting a complex stage for upcoming Federal Reserve decisions and broader economic forecasts.

Key Takeaways:

- Dow’s Outstanding Week: The Dow Jones Industrial Average experienced its best week of 2024, rising by 2.16% over eight consecutive sessions. This impressive streak finished in a close of 39,512.84, adding 125.08 points, or 0.32%, on the final trading day.

- S&P 500 and Nasdaq Composite Trends: The S&P 500 also showed strength, increasing by 1.85% over the week, ending at 5,222.68 after a daily rise of 0.16%. The Nasdaq Composite, however, saw a marginal dip of 0.03%, closing at 16,340.87, highlighting mixed sentiments in the tech sector.

- European Markets Achieve New Heights: European stocks closed the week on a high note, with the Stoxx 600 index up by 0.8%. This was supported by strong performances in mining and utilities sectors, up 1.3% and 1.5%, respectively. All major bourses were in the green, with Germany’s Dax, France’s CAC 40 and FTSE 100 Index higher, with the latter ending the week 2.68% higher at 8433.76.

- UK Economy Exits Recession: The UK reported a GDP growth of 0.6% for the first quarter, surpassing the forecast of 0.4%. This positive turn helped the UK to officially exit the recession it entered in the second half of 2023, offering a glimmer of hope for its economic recovery.

- Asian Markets Rally on Rate Cut Hopes: In Asia, the Hang Seng index led gains with a 2.32% rise, hitting a 10-month high. The CSI 300 index of mainland China also climbed to its highest level since October 2023, closing at 3,666.27, fuelled by renewed rate cut hopes in the U.S.

- Consumer Sentiment and Inflation Concerns: Despite strong market performances, US consumer sentiment dipped to 67.4, significantly below the expected 76, indicating rising concerns about inflation which could influence future Federal Reserve decisions and market stability.

- Oil Prices Fall Amid Interest Rate Concerns: Brent crude futures and US West Texas Intermediate crude both faced declines due to indications of higher-for-longer US interest rates and a strengthening US dollar. Brent crude settled down 1.3% at $82.79 a barrel, while West Texas Intermediate shed 1.26% to $78.26 a barrel.

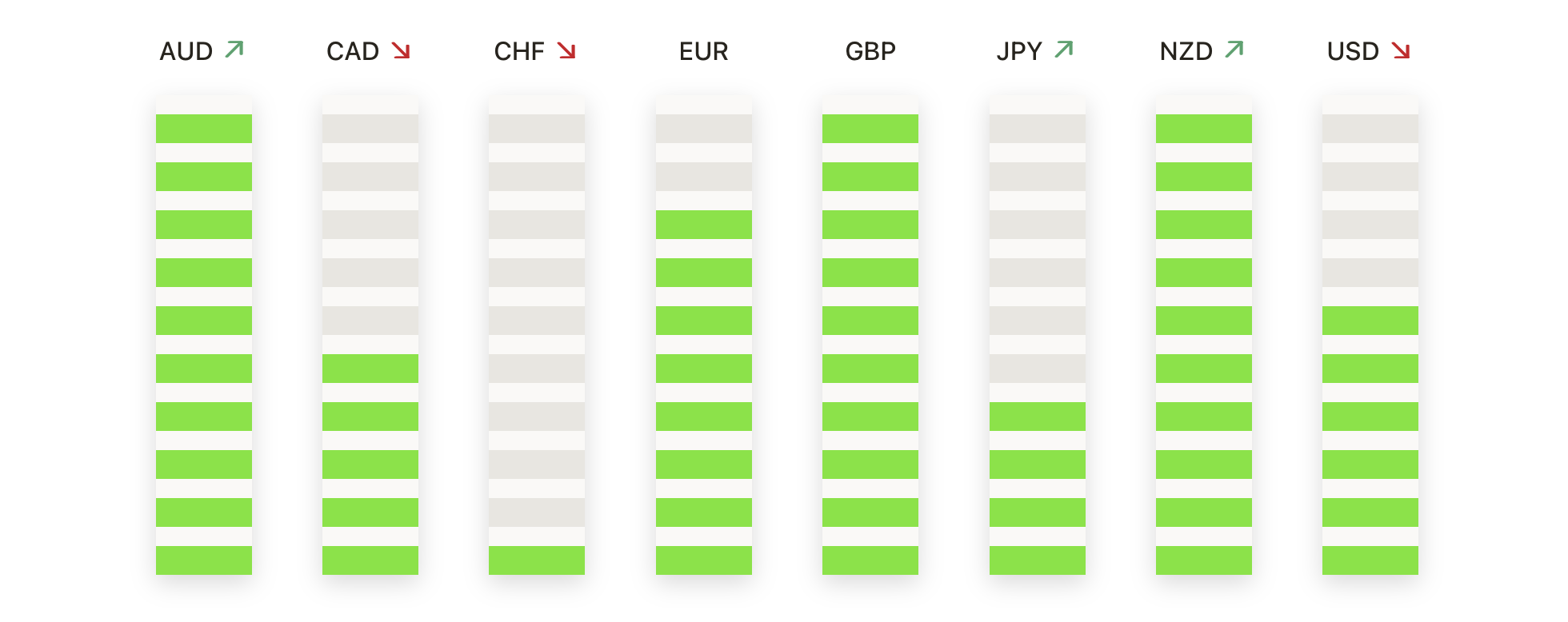

FX Today:

- Gold Advances Despite a Strong US Dollar: Gold prices showed resilience as they advanced on weaker-than-expected US economic data, despite the strength of the US dollar. Gold remains bullishly biased, with the Relative Strength Index (RSI) indicating increased buying momentum since early May. XAU/USD has consolidated around $2,360-$2,378, with a potential target of the April 19 high at $2,417 and possibly testing the all-time high of $2,431.

- EUR/USD Faces Resistance at Key Averages: The EUR/USD pair rose modestly but continues to struggle against resistance at the 50-day and 200-day simple moving averages at 1.0790. If it breaks through, it could challenge further resistance at 1.0810 and possibly 1.0865. Support lies at 1.0725 and 1.0695, with a potential drop toward 1.0645 if downward momentum intensifies.

- GBP/USD Maintains Support Amid Downward Pressure: GBP/USD has slightly declined but managed to stay above the critical support level at 1.2500. Resistance is noted around 1.2600 to 1.2630, a zone that could challenge the bulls, while a breakthrough could target the 1.2720 level.

- USD/JPY Looks to Test Higher Levels: USD/JPY has regained strength, surpassing 155.50, and now aims for resistance at 158.00 and potentially 160.00. Watch for possible FX interventions by Japanese authorities, which could reverse gains sharply. Support is established at 154.65 and 153.15, with further support near the 50-day SMA above 152.00.

- USD/CAD Tests Key Technical Levels: USD/CAD briefly dipped below 1.3620 but rebounded above 1.3660. The pair is capped by the 200-hour EMA at 1.3700, with ongoing support from the 50-day EMA at 1.3637. The pair’s momentum appears constrained as it begins to consolidate after retracing from a swing high near 1.3850.

Market Movers:

- Chip Stocks Shine on Nasdaq: In a standout performance on Friday, Micron Technology (MU) led the charge, closing up 2.91%. Other semiconductor players also saw significant gains, with Applied Materials (AMAT), NVIDIA (NVDA), ASML Holding (ASML), and Marvel Technologies (MRVL) all rising more than 1%.

- Moderna and Big Tech Slip: On the downside, Moderna (MRNA) fell sharply by 4.39%, while major tech firms like Tesla (TSLA), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOG) also faced declines ranging from 0.77% to 2.04%.

- Novavax Rockets on Licensing Deal: Novavax (NVAX) surged an impressive 98% following the announcement of a $1.2 billion licensing agreement with Sanofi for the commercialisation of a combined Covid and flu shot.

- HSBC Lifts 3M Outlook: 3M (MMM) rose 1.53% after HSBC upgraded its rating to buy from hold, reflecting a positive view on the company’s ongoing restructuring efforts.

- Taiwan Semiconductor Reports Strong Sales: Taiwan Semiconductor Manufacturing experienced a jump of 4.5% after reporting a 60% increase in year-over-year April revenues, boosted by sustained demand for artificial intelligence applications.

- Sweetgreen Outperforms on Revenue Beat: Sweetgreen (SG) jumped 34% after beating first-quarter revenue expectations with $158 million, slightly above the LSEG estimate of $152 million. The company also raised its full-year guidance for revenue and adjusted EBITDA.

- Unity Software Drops on Earnings Miss: Unity Software (U) saw a decline of 10% after posting a wider-than-expected first-quarter loss of 75 cents per share, compared to the 63 cents anticipated by analysts. The company projected adjusted EBITDA for Q2 to be between $75 million and $80 million, below Wall Street’s consensus of $98 million.

- Akamai Technologies Underwhelms on Mixed Results: Akamai Technologies (AKAM) decreased by 11% due to a weak outlook and mixed quarterly results, with expected annual revenues ranging between $3.95 billion and $4.02 billion, below analysts’ expectations of $4.08 billion for the year.

- Array Technologies Surpasses Expectations: Array Technologies (ARRY) advanced 2% after reporting better-than-expected Q1 results, with adjusted earnings of 6 cents per share on revenue of $153.4 million, outperforming analyst expectations for a loss on $141.2 million revenue.

- Victoria’s Secret Exceeds Preliminary Estimates: Victoria’s Secret (VSCO) saw its shares rise over 5% after reporting better-than-expected preliminary first-quarter results and reaffirming its guidance, expecting adjusted earnings to range between 7 cents and 12 cents per share.

As the week concludes, the financial markets have showcased instability and opportunity, showing the how complex the current economic conditions are. The healthy performance of the Dow and European markets contrasts with the subtle movements in the forex and commodities sectors, where concerns over inflation and central bank policies continue to inject uncertainty. Notably, the standout gains in semiconductor stocks and significant gains by companies like Novavax and Sweetgreen reflect investor optimism in specific sectors, despite broader market anxieties over inflation and consumer sentiment. Investors are closely monitoring economic indicators and corporate earnings to gauge the potential direction of market movements as we move further into the year.